In an increasingly fast-paced world, the availability of cash at our fingertips has become a staple of everyday convenience. Automated Teller Machines, or ATMs, have evolved remarkably since their inception, revolutionizing the way we interact with our finances. From simple cash withdrawals to complex transactions involving deposits and balance inquiries, these machines play a crucial role in modern banking.

As we navigate through our daily routines, ATMs have become indispensable tools that provide not only accessibility to funds but also a sense of security and independence. Companies like ATMgeorgia are at the forefront of this evolution, offering a wide array of services including cash loading, installation, and deinstallation of ATMs. Their expertise ensures that businesses and individuals alike can depend on these machines to meet their financial needs seamlessly.

Request A Demo

The Rise of ATMs: A Game Changer in Banking

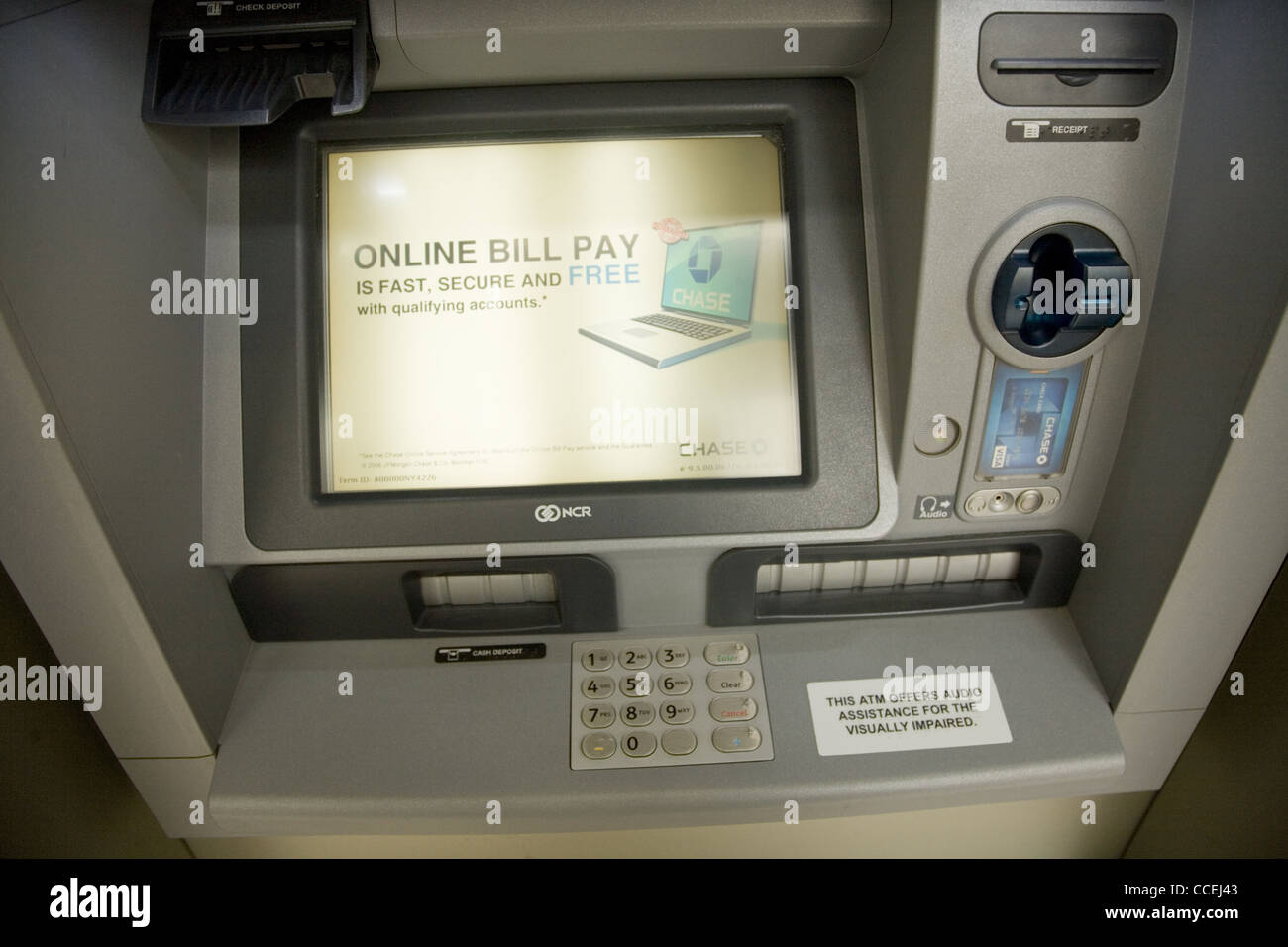

The introduction of Automated Teller Machines, or ATMs, revolutionized the way people interact with banks and manage their finances. Before the advent of ATMs, banking was primarily a time-consuming process that required visiting a branch during business hours. With the installation of ATMs, customers gained the ability to access their accounts, withdraw cash, and perform transactions at any time of the day or night, dramatically increasing convenience and efficiency.

As ATMs became more widespread, they contributed significantly to the democratization of banking services. Regions that previously had limited access to banking facilities saw significant improvements, as ATMs enabled cash transactions in remote areas. This accessibility helped bridge the gap between urban and rural financial services, allowing more people to engage with their finances and participate in the economy.

The evolution of ATMs has also embraced technological advancements, incorporating features such as touch screens, card readers, and even the option to deposit cash and checks. Companies like ATMgeorgia have played a pivotal role in this transformation by providing services such as cash load processing, installation, and de-installation of ATMs. This evolution has ultimately not only changed banking practices but has also reinforced the central role of cash in daily transactions.

ATMgeorgia: Pioneering Innovative ATM Solutions

ATMgeorgia stands out in the ATM industry by offering cutting-edge solutions that cater to the evolving needs of businesses and consumers alike. With a strong focus on technology and customer service, ATMgeorgia has made it their mission to provide reliable ATM services that enhance convenience. Their commitment to innovation is evident in their range of offerings, including cash load services and seamless installation and de-installation processes.

One of the key advantages of partnering with ATMgeorgia is their expertise in managing both the technical and logistical aspects of ATM operations. Their team works closely with clients to ensure that each machine is optimally placed and fully stocked, minimizing downtime and maximizing customer satisfaction. This dedication to service ensures that every transaction is smooth and efficient, contributing to a positive experience for users.

In addition to traditional ATM services, ATMgeorgia is continuously exploring new technologies and features that enhance user interaction. From advanced security measures to mobile integration, the company’s forward-thinking approach positions them as leaders in the industry. By staying ahead of trends and understanding the demands of modern consumers, ATMgeorgia is shaping the future of ATM usage in daily life.

Cash Management: The Role of Cash Loading Services

Cash loading services play a crucial role in the overall efficiency of ATM operations, ensuring that machines are stocked with the necessary funds to meet customer demand. With the increasing reliance on ATMs for daily transactions, maintaining optimal cash levels becomes essential for both service providers and users. Companies like ATMgeorgia specialize in managing these cash loads, providing timely replenishment to prevent machine outages and enhance user experience.

The process of cash loading involves meticulous planning and coordination. ATMgeorgia not only installs and de-installs machines but also monitors cash levels in real time. This data-driven approach allows for proactive loading schedules that align with peak usage times. By optimizing cash management, businesses can reduce the risk of revenue loss due to insufficient funds in ATMs, thereby maximizing profitability.

Furthermore, cash loading services contribute to enhanced security measures for cash handling. ATMgeorgia employs trained personnel and secure transportation methods to mitigate the risks associated with cash movement. This dedication to safe cash management not only protects assets but also instills confidence in users, ensuring that they can access funds whenever needed.

Future Trends: The Next Phase of ATM Evolution

As technology continues to advance, the future of ATMs is poised for significant transformation. One of the key trends is the integration of biometric security features, such as fingerprint and facial recognition. This evolution aims to enhance security, making transactions safer and more convenient for users. These innovations could eliminate the need for PINs, streamlining the withdrawal process while reducing the risk of fraud.

Another trend to watch is the expansion of services beyond cash withdrawal and deposit. ATMs are becoming multifunctional, offering services like bill payments, mobile top-ups, and even financial advice through interactive screens. This shift reflects a growing demand for convenience and accessibility, allowing customers to manage their finances more effectively from a single point. Companies like ATMgeorgia are likely to play a significant role in this transition by installing and maintaining these advanced machines.

Furthermore, the integration of digital currencies into ATM systems is on the horizon. With the rise of cryptocurrencies, we may soon see ATMs capable of facilitating crypto transactions, allowing users to buy or sell digital assets with ease. This evolution could attract a new demographic of tech-savvy users and create a more comprehensive financial ecosystem, reinforcing the relevance of ATMs in a rapidly changing economic landscape. Companies that specialize in processing cash load and installation will need to adapt to keep pace with these developments.