Are you looking to unlock the secrets of financial success in business? Well, you’ve come to the right place! In the world of business, understanding and managing your finances is key to achieving long-term success. Whether you’re a seasoned entrepreneur or just starting out, having a solid grasp of business finance is essential for making informed decisions and maximizing your profitability.

In this comprehensive guide, we will delve into the world of business finance, uncovering the fundamental concepts and strategies that will help you navigate the financial landscape with confidence. From understanding financial statements to analyzing cash flow, we will provide you with the tools and knowledge to gain a clear view of your company’s financial health.

But it doesn’t stop there – we will also explore the intricate world of business tax law. As a business owner, staying compliant with tax regulations is crucial to avoiding penalties and ensuring your financial success. Our guide will walk you through the essentials, from understanding your tax obligations to maximizing deductions, enabling you to make the most of your financial resources.

So, whether you’re seeking to enhance your financial acumen or looking for actionable advice to optimize your business’s financial performance, this guide is your roadmap to unlocking the secrets of financial success in the world of business finance. Get ready to take control of your finances and propel your business towards prosperity!

Understanding Business Finance

Microcaptive

In order to achieve financial success in business, it is imperative to have a clear understanding of business finance. Business finance refers to the management and allocation of funds within a company to support its operations, growth, and profitability. It involves various aspects such as budgeting, financial analysis, investment decisions, and risk management.

One crucial aspect of business finance is budgeting. A well-defined budget helps in planning and controlling the financial resources of a business. By setting financial goals and allocating funds accordingly, businesses can effectively manage their expenses and ensure proper utilization of resources. A budget also aids in identifying areas where costs can be optimized and resources can be allocated for maximum efficiency.

Another important aspect of business finance is financial analysis. This involves assessing the financial health of a business by analyzing its financial statements, such as the income statement, balance sheet, and cash flow statement. By examining these statements, businesses can gain insights into their revenue, expenses, assets, and liabilities. Financial analysis enables businesses to evaluate their performance, identify areas of improvement, and make informed decisions regarding investments, debt management, and profit maximization.

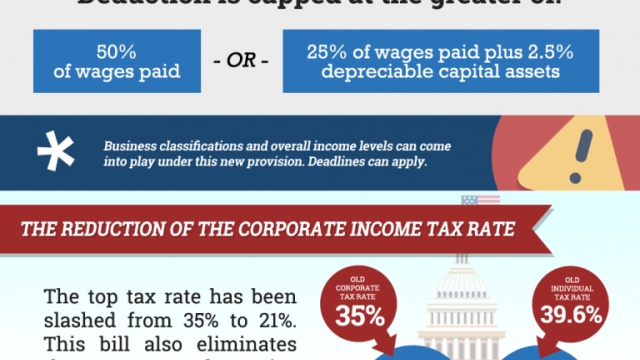

Business finance also encompasses understanding and adhering to the relevant tax laws. Complying with business tax laws is essential to avoid legal penalties and ensure accurate financial reporting. It is crucial for businesses to stay updated with changes in tax regulations and consult with tax professionals to navigate the complexities of tax planning and compliance.

In summary, understanding business finance is fundamental to achieving financial success in business. By mastering concepts such as budgeting, financial analysis, and tax law compliance, businesses can effectively manage their financial resources, make informed decisions, and propel their growth and profitability.

Navigating Business Tax Laws

In order to achieve financial success in business, it is crucial to have a strong understanding of business tax laws. These laws play a significant role in determining how businesses should manage their finances and report their taxable income. By navigating the complexities of business tax laws, entrepreneurs can ensure compliance and make informed financial decisions.

One key aspect of navigating business tax laws is understanding the tax obligations that businesses are subject to. Different jurisdictions may have varying tax requirements, such as income tax, sales tax, or payroll tax. Business owners should familiarize themselves with the specific tax laws applicable to their location and industry to avoid any penalties or legal issues.

Another important consideration is tax planning and optimization. A comprehensive understanding of business tax laws allows entrepreneurs to strategize and maximize their deductions, credits, and exemptions, resulting in tax savings. By leveraging these provisions, businesses can effectively manage their cash flow and allocate resources for further growth and investment.

Lastly, staying updated with changes in business tax laws is crucial to maintain compliance and reap the benefits of new tax incentives. Tax laws are subject to revisions and updates, making it essential for business owners to stay informed about any changes that may impact their financial obligations. Engaging with tax professionals or consulting relevant resources can help entrepreneurs stay up to date and adapt their financial strategies accordingly.

In conclusion, navigating business tax laws is an integral component of achieving financial success in business. It involves understanding tax obligations, optimizing tax planning, and staying updated with any changes in tax regulations. By mastering these aspects, entrepreneurs can ensure compliance, maximize tax savings, and pave the way for sustained growth and profitability.

Strategies for Financial Success

When it comes to achieving financial success in business, there are several strategies you can implement to maximize your chances of reaching your goals. By following these key principles, you can effectively manage your business finances and position your company for long-term success.

Set Clear Financial Goals: Begin by setting clear and measurable financial goals for your business. Whether it’s increasing revenue, reducing costs, or improving profitability, having specific targets will provide you with a clear roadmap for success. Regularly track your progress and make adjustments as needed to stay on course.

Develop a Comprehensive Budget: A well-planned budget is essential for effective financial management. Take the time to analyze your revenue streams, expenses, and cash flow patterns to create a budget that aligns with your business objectives. Regularly review and update your budget to ensure its accuracy and relevance.

Understand Business Tax Laws: Familiarize yourself with the tax laws that are applicable to your business. This will help you identify potential tax deductions and credits, optimize your tax strategy, and ultimately minimize your tax liability. Consulting with a tax professional can provide valuable guidance in navigating the complex world of business taxation.

Remember, financial success in business requires a proactive approach and ongoing effort. By implementing these strategies and continuously evaluating your financial performance, you can position your business for long-term growth and profitability.