Workers Compensation Insurance is an essential aspect of protecting both employers and employees alike. As an employer, ensuring the well-being and safety of your workforce is of utmost importance, and Workers Compensation Insurance serves as a shield against potential financial burdens in the event of work-related injuries or illnesses. For employees, this coverage provides the assurance that medical bills, lost wages, and other related expenses will be taken care of in case of an unfortunate incident.

In the bustling world of commercial insurance in California, understanding the ins and outs of Workers Compensation Insurance becomes crucial. As a responsible business owner, being well-informed about the requirements, benefits, and potential pitfalls is essential for your peace of mind. Moreover, knowledge of the various factors that influence the premium rates and the claims process can empower you to make informed decisions when selecting a policy that suits your specific business needs.

Restaurant owners in California, in particular, find themselves at the crossroads of the culinary industry’s vibrant offerings and the regulatory measures pertaining to workplace safety. With a comprehensive understanding of Workers Compensation Insurance, restaurant insurance needs can be properly addressed – from ensuring coverages for possible slip-and-fall incidents to protecting against claims arising from food-related allergies or injuries.

Similarly, when it comes to commercial auto insurance in California, a guide covering Workers Compensation Insurance is invaluable. Employers whose businesses involve transportation, delivery, or any form of driving can navigate potential risks and liabilities better when equipped with the knowledge of how Workers Compensation Insurance intersects with commercial auto coverage.

Professional Liability Insurance in California

In this article, we delve into the intricacies of Workers Compensation Insurance, unraveling its complexities and shedding light on the key aspects that business owners in California need to be aware of. By understanding the importance of proper coverage, the potential savings through policy customization, and the necessary steps involved in navigating the claims process, employers can confidently cover their bases and ensure the well-being of their employees and the financial stability of their business.

Understanding Workers Compensation Insurance

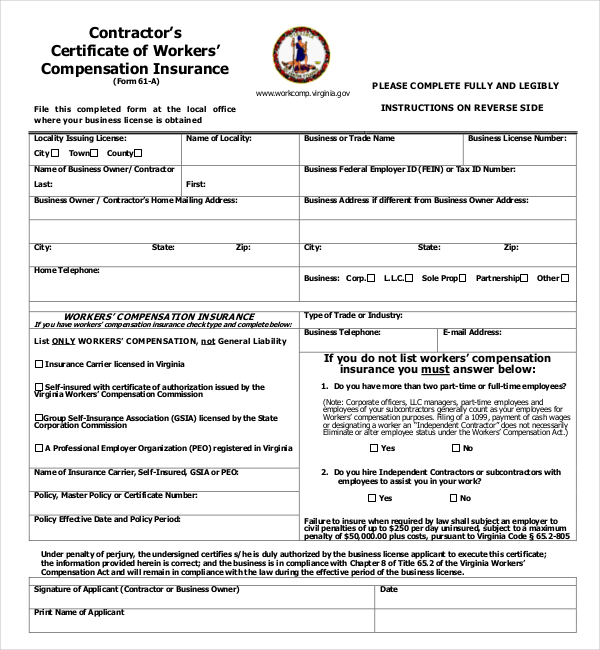

Workers Compensation Insurance is a crucial component for any business operating in California. This type of commercial insurance provides coverage for employees who suffer work-related injuries or illnesses. It is designed to protect both the employees and the employers in case of accidents or health issues that occur during the course of employment.

In California, workers compensation insurance is mandatory for businesses with employees. It ensures that injured workers receive proper medical treatment and compensation for lost wages while protecting employers from potential lawsuits related to workplace accidents. This insurance coverage not only offers financial security but also promotes a safe working environment for employees.

For businesses in the restaurant industry, having adequate workers compensation insurance is particularly important. With a higher risk of injuries compared to many other industries, restaurant owners need to be prepared for potential workplace accidents or illnesses that may arise from tasks like lifting heavy objects, working with hazardous equipment, or slips and falls in the kitchen.

Additionally, commercial auto insurance is another essential aspect to consider for businesses operating in California. This insurance coverage protects the vehicles used for commercial purposes, including those owned or leased by the business. Having proper commercial auto insurance ensures that any accidents or damages involving the business vehicles are covered, minimizing financial liability for the business.

Understanding workers compensation insurance, along with other necessary commercial insurance coverages such as restaurant insurance and commercial auto insurance, is crucial for businesses in California. By familiarizing themselves with the different insurance requirements and obtaining the appropriate coverage, businesses can safeguard their employees, finances, and overall operations.

Commercial Insurance California Guide

In California, businesses of all types and sizes are required to have commercial insurance to protect themselves from potential liabilities. Whether you own a small restaurant or a large manufacturing plant, having the right insurance coverage is crucial. Commercial insurance in California provides financial protection and peace of mind for business owners in the event of unexpected accidents, lawsuits, or other unforeseen events.

One aspect of commercial insurance that is particularly important for businesses in California is restaurant insurance. As the restaurant industry can be quite demanding and unpredictable, having the right coverage is essential. Restaurant insurance in California typically includes general liability coverage, which protects against third-party claims of bodily injury or property damage caused by your restaurant’s operations. Additionally, it may also include coverage for equipment breakdown, food spoilage, liquor liability, and workers compensation insurance.

Another important aspect of commercial insurance in California is commercial auto insurance. If your business owns any vehicles that are used for work-related purposes, it is crucial to have proper coverage. Commercial auto insurance provides protection for your company vehicles and the drivers operating them. This insurance can often cover damages to the vehicle, medical expenses for injuries, and any legal costs associated with an accident.

As a business owner in California, it is essential to understand the specific insurance needs of your industry and the regulations imposed by the state. By working with a reputable insurance provider, you can ensure that your business is adequately protected and that you meet all the necessary legal requirements. Additionally, an insurance professional can help tailor a commercial insurance policy that suits the unique needs of your business, providing you with optimal coverage and peace of mind.

Restaurant Insurance California Guide

- Coverage for Business Property

Restaurant insurance in California provides coverage for the physical property of your business. This includes your restaurant building, equipment, furniture, and fixtures. In the event of a fire, theft, or other covered perils, this insurance can help you recover financially by reimbursing you for the damages or losses incurred. It is essential to accurately assess the value of your business property to ensure you have adequate coverage.

- Liability Protection

Another crucial aspect of restaurant insurance in California is liability protection. Accidents can happen in any establishment, and the food service industry is no exception. Whether it’s a slip and fall incident, food poisoning, or any other incident that leads to injury or property damage, liability insurance can provide the necessary coverage. With liability protection, you can have peace of mind knowing that your restaurant is financially safeguarded against potential legal claims and expenses.

- Workers Compensation Insurance

As an employer in California, you are legally required to have workers compensation insurance for your restaurant staff. This insurance provides coverage for medical expenses, lost wages, and disability benefits if an employee gets injured or falls ill while on the job. Workers compensation insurance helps protect both your employees and your business by ensuring that medical costs and other related expenses are taken care of. It is essential to comply with California state regulations and provide the necessary coverage to your employees.

Remember, running a restaurant in California comes with its unique risks, and having the right insurance coverage is crucial for protecting your business and its assets. By understanding the various types of coverage available, such as business property, liability protection, and workers compensation insurance, you can ensure comprehensive protection for your restaurant and focus on providing exceptional dining experiences to your patrons.