Welcome to the world of car insurance, where understanding the basics can lead you down a road of financial security and peace of mind. Whether you’re a new car owner or simply looking to refresh your knowledge, it’s crucial to grasp the ins and outs of this essential form of protection. In this article, we’ll delve into the key aspects of car insurance, shedding light on the importance of coverage, the differences between homeowners and auto insurance, and ultimately, how to navigate the often complex world of car insurance to ensure you’re making the right decisions for your needs. So sit back, buckle up, and let’s hit the road to unravel the mysteries of car insurance.

Understanding Homeowners Insurance

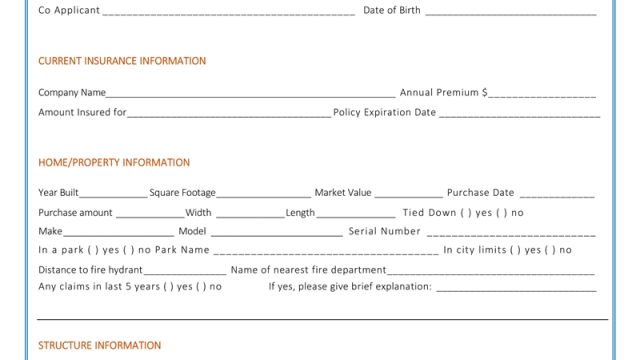

Homeowners insurance is a vital form of protection that every homeowner should consider. It provides coverage for your home and its contents in case of unexpected events like theft, fire, or natural disasters. Having homeowners insurance ensures that you are financially protected and can easily recover from any damages or losses.

The primary purpose of homeowners insurance is to safeguard your home, its structure, and the possessions inside it. It typically covers the cost of repairs or rebuilding your home if it is damaged or destroyed due to covered perils. Additionally, homeowners insurance often includes liability protection, which covers legal expenses if someone is injured on your property.

Different insurance policies offer various levels of coverage, and it’s essential to select one that best suits your needs. Factors like the location of your home, its age, and the value of your belongings will influence the cost and extent of coverage required. It’s crucial to carefully review your policy to ensure that it adequately covers your home and possessions.

Remember, homeowners insurance is separate from car insurance or auto insurance, which is specifically designed to protect your vehicles. While they are distinct, it’s common for insurance providers to offer bundled packages that include both homeowners and auto insurance, allowing you to conveniently manage all your insurance needs in one place.

Understanding homeowners insurance is crucial to creating a secure foundation for protecting your home and belongings. By comprehending the basics of homeowners insurance, you can make informed decisions regarding coverage levels and ensure you have the necessary protection for your most valuable assets.

Exploring Car Insurance

Car insurance is an essential aspect of owning and driving a vehicle. It provides financial protection in case of unexpected events like accidents, theft, or damage to your car. Understanding the basics of car insurance is crucial for every driver, whether you are a seasoned driver or a new one hitting the road for the first time.

When it comes to car insurance, there are various types of coverage available to meet different needs and budgets. One common type is liability coverage, which helps cover the costs if you are at fault in an accident and cause injury or damage to others. Another type is comprehensive coverage, which protects your car from non-accident-related incidents such as theft, vandalism, or natural disasters.

It’s worth noting that car insurance is not the same as homeowners insurance. Homeowners insurance primarily covers your home and its contents, while car insurance focuses specifically on your vehicle and associated risks. While it’s common for people to have both types of coverage, they serve different purposes and require separate policies.

Understanding the essentials of car insurance is the first step towards making informed decisions about your coverage. By familiarizing yourself with the types of coverage available and their benefits, you can better protect yourself, your car, and others on the road.

Mastering Auto Insurance

When it comes to auto insurance, understanding the basics is crucial. It not only protects you financially in case of an accident but also ensures that you comply with legal requirements. Let’s dive into the essential aspects of auto insurance.

First and foremost, it’s important to know the types of coverage available. Liability coverage is the most common and typically required by law. This coverage helps pay for damages caused to others in an accident for which you are at fault. On the other hand, collision coverage helps repair or replace your vehicle if it is damaged in a collision, regardless of fault. Comprehensive coverage takes care of non-collision-related damages like theft, vandalism, or natural disasters.

In addition to these primary coverage types, there are optional coverages available. One such option is uninsured/underinsured motorist coverage, which protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough coverage. Another crucial optional coverage is medical payments coverage, which helps pay for medical bills resulting from an accident, regardless of fault.

To make the most of your auto insurance, it’s important to review your policy regularly. Assess your coverage limits to ensure they provide adequate protection. Evaluate whether your deductible—the amount you pay out of pocket before insurance kicks in—is suitable for your financial situation. Furthermore, consider any additional features or endorsements that might be beneficial for your specific needs, such as roadside assistance or rental car coverage.

bhs insurance

Remember, comparing quotes from different insurance providers can help you find the best rates and coverage options. Don’t hesitate to reach out to insurance agents for expert guidance tailored to your individual circumstances. By understanding the fundamentals of auto insurance and customizing your policy accordingly, you can hit the road with confidence and peace of mind.