In today’s dynamic global economy, trade finance and project finance play a pivotal role in unlocking economic growth. Facilitating transactions and investments across borders, these financial mechanisms bridge the gap between businesses seeking capital and investors looking for lucrative opportunities. As businesses strive to expand their operations and explore new markets, the need for efficient and reliable financing solutions becomes increasingly paramount.

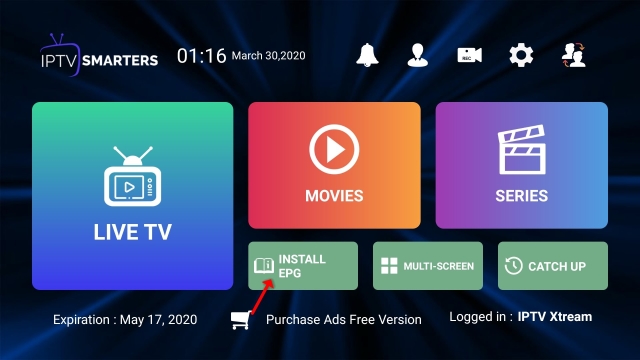

Enter "Financely-Group," a digital platform that revolutionizes the way businesses connect with capital allocators. By leveraging innovative technology, Financely-Group provides a seamless interface, connecting businesses of all sizes to a vast network of potential investors. Whether it’s trade finance or project finance, this platform offers a streamlined process that enables businesses to raise capital quickly and efficiently.

Trade finance, in particular, plays a vital role in facilitating international trade. With the complexities and risks involved in cross-border transactions, businesses often require financial assistance to bridge gaps in cash flow, secure inventory or raw materials, and manage the various legal and logistical aspects of international trade. Through trade finance solutions offered by Financely-Group, businesses can access the necessary funds to navigate these challenges and seize growth opportunities.

On the other hand, project finance addresses the specific needs of businesses undertaking large-scale ventures. Whether it’s infrastructure development, renewable energy projects, or real estate initiatives, securing adequate funding for such endeavors can be a daunting task. However, through the platform provided by Financely-Group, businesses can now simplify the project finance process, attracting investors who recognize the potential for long-term returns on these ambitious ventures.

In a world where time is of the essence, traditional financing methods often fall short in meeting the growing demands of businesses. The role of technology and digital platforms like Financely-Group cannot be understated, offering businesses a game-changing solution to expedite capital raising efforts. With trade finance and project finance at their fingertips, businesses can unlock their true potential, accelerating economic growth and fostering a more interconnected global marketplace.

The Importance of Trade Finance in Economic Growth

Trade finance plays a crucial role in promoting economic growth by facilitating international trade and enabling businesses to expand their operations across borders. With the help of trade finance, businesses can mitigate risks, access working capital, and ensure the smooth flow of goods and services. This section explores the significance of trade finance in driving economic growth.

First and foremost, trade finance provides the necessary funding for businesses to engage in import and export activities. By providing short-term credit solutions such as letters of credit and trade loans, financial institutions enable companies to bridge the gap between the shipment of goods and the receipt of payment. This helps businesses fulfill orders, maintain inventory levels, and meet customer demands without facing cash flow constraints.

Furthermore, trade finance reduces the risks associated with cross-border transactions. Through mechanisms like trade credit insurance and export financing, businesses can protect themselves against payment defaults and political uncertainties in foreign markets. By mitigating these risks, trade finance encourages businesses to explore new markets and seize growth opportunities, ultimately contributing to overall economic expansion.

Additionally, trade finance enhances the efficiency of supply chains and fosters international trade relationships. By providing financing options for both buyers and suppliers, trade finance enables seamless transactions and promotes trust between trading partners. This improved efficiency and trust lead to enhanced business collaborations, increased productivity, and ultimately, economic growth.

In conclusion, trade finance acts as a catalyst for economic growth by providing businesses with the necessary financing, managing risks, and bolstering international trade relationships. As global trade continues to flourish, trade finance will remain a critical tool for businesses to expand their operations, drive innovation, and contribute to the overall prosperity of economies worldwide.

The Role of Project Finance in Driving Development

Project finance plays a vital role in driving development by fueling economic growth and fostering infrastructure projects. Through its unique structure, project finance enables businesses and governments to undertake large-scale initiatives that might otherwise be challenging to fund. By attracting capital from investors and financial institutions, project finance helps bring ambitious ventures to life, creating jobs, improving public services, and uplifting communities.

One of the key advantages of project finance is its ability to mitigate risk for all stakeholders involved. In traditional financing models, companies or governments often bear the sole burden of both the investment and operational risks associated with a project. However, project finance allows for the allocation of risks among different parties involved, such as lenders, investors, and project sponsors. By spreading risks in this manner, project finance encourages collaboration and incentivizes private sector participation, making it possible to take on projects that would be otherwise financially unfeasible.

Furthermore, project finance has proven to be particularly instrumental in developing countries, where infrastructure development is crucial for sustained growth. In many emerging economies, governments face limitations in accessing immediate funds for infrastructure projects. This is where project finance steps in, offering an avenue for businesses and governments to secure the necessary capital. By providing the financial support needed, project finance contributes to bridging the infrastructure gap in developing nations, paving the way for progress and economic prosperity.

In recent years, digital platforms like the "financely-group" have also emerged, revolutionizing project finance. These platforms serve as efficient intermediaries, connecting businesses and capital allocators seamlessly. By leveraging technology, these platforms streamline the process of raising capital, making it quicker and more accessible for businesses of all sizes. Through such digital advancements, project finance can be harnessed more effectively, propelling development projects forward and unlocking their full potential.

In conclusion, project finance plays a crucial role in driving development by facilitating the implementation of ambitious infrastructure projects. Through its unique risk-sharing structure and the emergence of digital platforms, project finance has become an essential mechanism for attracting capital and delivering economic growth. By embracing and optimizing project finance, businesses, governments, and communities can together unlock new opportunities and forge a path towards a more prosperous future.

Enhancing Capital Allocation through the Financely Group Platform

The Financely Group platform plays a crucial role in enhancing capital allocation for businesses seeking financial support for trade and project ventures. By connecting businesses with capital allocators, the platform accelerates the process of raising capital, enabling companies to access the funds they need quickly and efficiently.

One key advantage of the Financely Group platform is its ability to streamline the capital raising process. Through its digital framework, businesses can present their trade and project finance requirements to potential capital allocators in a structured and organized manner. This eliminates the need for tedious paperwork and lengthy negotiations, allowing companies to focus on their core operations while efficiently navigating the finance-raising process.

Another noteworthy feature of the Financely Group platform is its extensive network of capital allocators. By leveraging this network, the platform increases the visibility of businesses seeking funding, ensuring they reach a wide array of potential investors. This broad exposure to capital allocators enhances the likelihood of securing the required financial resources, propelling trade and project ventures forward.

Furthermore, the Financely Group platform offers businesses access to valuable insights and expertise. Through its collaboration with industry experts and experienced professionals, the platform provides guidance and advice on fund allocation strategies, helping businesses make informed decisions about capital utilization. This invaluable support enables companies to utilize their allocated capital effectively, leading to enhanced economic growth and sustainable development.

View Details

The Financely Group platform empowers businesses by facilitating the efficient and effective allocation of capital for trade and project finance. As more companies recognize its potential, this digital platform is reshaping the landscape of capital allocation, unlocking economic growth and enabling businesses to realize their growth aspirations.